Last fall, the online investing company Robinhood was all over the news. Why? Because young (often uninformed) teenagers were investing their hard-earned money by using the free trading app as they would a video game and losing real cash. With no brokers facilitating trades, no commission fees and easy access to online trading via smartphones, interest in stock market trading has increased.

Apps are not the only way new investors connect with the stock market. Meme stocks rely on a group of online investors touting a particular company, thus creating a surge in interest in the company and a buying frenzy. GameStop, whose stock climbed 1700% in one week in early 2021, is the most well-known example of a meme stock. However, Robinhood shut down trading for GameStop in an effort to force the investors to sell their sky-high stocks.

The inequality between Wall Street investors and the general public fostered meme stocks as a way to create a more democratic stock market. However, according to the Financial Times, inexperienced investors, equipped with a smartphone and no-fee trading, were the biggest losers.

Ashley Abbonizio ’22, a recent psychology graduate with a minor in human resource management, knows quite a few people who have dumped their savings into investing apps and cryptocurrency. “I have a friend who put in a lot of money and lost it all. It reminds me of a gambling addiction,” she says. In Abbonizio’s experience, she recognizes that people love the adrenaline rush they get when they make money. She equates the current crypto craze to the Wild West. “It’s not regulated, and I don’t think there’s any rhyme or reason to it,” she adds.

Nearly 30% of financial planning students have stock market investments

Inside Higher Ed, an academic trade publication, conducted a survey in February 2022 regarding students’ financial literacy and reported that about four in 10 students rated their financial knowledge as either excellent or good, while only 12 percent rated it as poor. The survey also discovered that some students who invest in the stock market may feel overconfident in their financial knowledge. Nearly three in 10 students have stock market investments.

Immaculata faculty members teaching business and finance majors are surprised at the level of interest in investing from the students. “I definitely see a higher level of financial competence and an overall higher understanding of how the stock market operates from students than I did even five years ago,” states Elizabeth Faunce, Ph.D., professor of economics and finance.

According to members of Immaculata’s business faculty, young people are using trading apps such as Robinhood that are gamifying the investment process. People use these apps without a basic understanding of the risk-reward tradeoff and, therefore, may be subject to major losses.

At Immaculata, finance and financial planning majors learn fundamental and technical analysis in their securities analysis classes and learn securities industry essentials in their Financial Industry Regulatory Authority (FINRA-based) classes. While no one denies the importance of understanding how to handle personal finance and building wealth at a young age, learning the fundamentals of investing is important. Understanding how everything works together is essential.

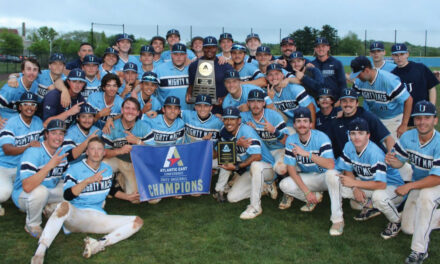

PICTURED L to R: Mark McFadden and students Nicholas Speakman-Viggiano, Emmanuel Banda, Carson McNally, Regina Carey and Emma Dunham attend a conference.

Immaculata students, including first-year business majors, may not yet possess these skills, but the faculty ensure that their students are prepared to handle their personal finances and, if students choose a career in financial planning, to help others do the same.

To build financial literacy for students, Immaculata freshmen are able to take the course Money, Money, Money as part of their First-Year Seminar, a selection of courses that helps students transition to college. The class provides an overview of personal finance and money management decisions. Students delve into the pros and cons of credit cards, review online tools and personal finance apps, budgeting, debt management, tax planning, saving, investing and retirement planning. In addition, students can major in a traditional corporate finance track or take the financial planning degree program, which is a Certified Financial Planner (CFP) Board-Registered Program, that satisfies the coursework requirements for the CFP™ certification.

One of the core classes is Business Ethics, taught by Sarah Dougherty, MBA, instructor in the department of business, fashion and leadership. Dougherty uses case studies from companies such as Enron and the Red Cross to analyze historic business scandals and uncover what caused them. “A lot of the course is focused on being reflective and understanding where our own lines are drawn—both professionally and personally—and working on strategies to ensure that we don’t cross those lines,” says Dougherty.

Dougherty stresses the fact that in many situations scandals occur because of poor judgment, stressful situations, executive pressure and pride. She tells her students, “The people that you read about in the news don’t show up to work one day and say, ‘Today is the day that I’m going to ruin everything.’”

“Save, save, save!” urges Regina Carey ’22. This is the advice the dual major in human resource management and finance and the president of the business club received after taking several finance classes. “Young professionals don’t realize the financial power they have if they begin to save their money as soon as they can,” she explains.

Carey took a financial planning class with Faunce that taught her to set goals to achieve financial success for her future. Carey used this plan to determine her risk-tolerance for each of her goals. Faunce had the students reflect on the reasons why they wanted to invest in the first place. In instructor Eileen Raffaele’s securities analysis course, she emphasized the importance of knowing exactly where your money is circulating and understanding how to harness that knowledge as an advantage through savings and stocks.

“In this unpredictable economic environment, Immaculata students are learning financial skills that will not only prepare them to pursue competitive careers in finance, banking and insurance, but also allow them to navigate through their own lifelong financial decisions,” states Faunce.

Carey recognizes that there will always be risks associated with finance, but in her finance classes she is learning ways to handle and recover from financial loss, and she feels better prepared to manage her personal finances in the future.

Although in folklore, Robin Hood stole from the rich to give to the poor, at Immaculata, students would rather learn how to create their own wealth, built on a foundation of financial literacy and integrity.